Contents:

In finance, a return is the profit or loss derived from investing or saving. Duration indicates the years it takes to receive a bond’s true cost, weighing in the present value of all future coupon and principal payments. For technical traders, moving averages are used for a variety of trend and reversal indicators. News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services.

Many investors do not average after they buy the same stock many times. This calculator is needed to get the correct average cost per share when the buying price differs. Pyramiding is an aggressive trading strategy that involves compounding one’s existing positions, as the share price moves in a desirable direction. It classifies as an averaging strategy due to the nature of growing the average price by putting in fresh positions into a trade where they expect bullish growth. It is suitable for those who can manage high-risk situations.

Stack Exchange network consists of 181 Q&A communities including Stack Overflow, the largest, most trusted online community for developeaverage price in stock market to learn, share their knowledge, and build their careers. For starters, sales are still robust, well ahead of pre-pandemic numbers. RH is still posting positive net income and free cash flow, and it’s in a fine cash position. We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information & latest updates regarding our products & services.

Buying the dips and adding to a position when the price falls can be profitable in a bull market but can increase losses in downtrends. Take an example, you bought 10 stocks of Tata Motors at a price of 200. You want to reduce the average stock price by buying more stocks but you need to calculate how many stocks you need to buy to make the average closer to the current price. Here comes this tool Share Average Calculator / Stock Average Calculator by FinanceX. In the finance sector, average price is mostly used in the context of bond prices.

Stocks open higher to start the week

Suppose you bought Reliance stocks at some price expecting that it will move upwards. But unfortunately, it didn’t go with your assumptions and it started moving downwards. But you still have faith in Reliance that it will move upwards. For this, you will start adding more stocks to reduce the average price of a stock. The Global Newborn Baby Care Products market is anticipated to rise at a considerable rate during the forecast period, between 2022 and 2028. In 2021, the market is growing at a steady rate and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

10 to 25 kg accounting for Percent of the Polypropylene Liner Bags global market in 2021, is projected to value USD million by 2028, growing at a revised Percent CAGR from 2022 to 2028. While Supermarkets/hypermarkets segment is altered to an Percent CAGR throughout this forecast period and will hold a share about Percent in 2028. I am a Canadian, and under Canadian tax laws, I think there are at least two ways of determining your cost basis for shares. I am not going to get into the details of tax accounting; please see a qualified tax professional for advice. I have searched but cant find the answer to a buy, sell and rebuy.

The global major manufacturers of Polypropylene Liner Bags include Aristo Flexi Pack., GLOBAL-PAK, National Bulk Bag, A-Pac Manufacturing, Plascon, Southern Packaging, AAA Polymer, Dana Poly and Berry Global, etc. In terms of revenue, the global 3 largest players have a Percent market share of Polypropylene Liner Bags in 2021. Your profit is 4$ on 7 shares sold at the end of the day , if we included sales in caliculation we reduce our price of next buy .

Watch What Is Average Price In Stock Market Video

The stock average calculator helps to do all the calculations easily and fast. These are some of the essential steps you should consider before averaging down. The method of averaging that we understand is averaging down because we average when the share price goes down. However, if stock prices tend to go up, and the investors gain more confidence in the stock and start buying more is called averaging up. Averaging in the stock market is a strategy to buy more shares of a company as its price falls, which results in a lower overall average buy price.

- This is particularly important because most investors buy shares at different times, also known as scaling into a position.

- Average total cost is calculated by dividing the total cost of production by the total number of units produced.

- Many online brokerage platforms will calculate an average stock price but it only does so after you’ve purchased the shares.

- Intraday data delayed at least 15 minutes or per exchange requirements.

If you’re an active trader, you want to know your average stock price because of liquidity, which means understanding how volume affects stock prices. Consider buying stocks when the price moves higher but when sufficient trading volume supports that movement. Or average down calculator, which allows you to enter the quantity of shares and stock prices on every occasion you purchase the shares. For example, the Dow Jones Industrial Average , which is a price-weighted average, covers 30 blue-chip stocks listed on the NYSE and is widely used to track overall U.S. stock market performance. It essentially takes the stock prices of its 30 components and then divides them by the “Dow divisor,” which is a number less than one.

A fresh position is always taken on the trader’s discretion based on an assessment of chart pattern breakouts, moving average breakouts, penetration of resistance levels and other technical analysis. Most investors never buy an entire allocation to a stock in one purchase. Some might dollar-cost average into a stock by investing a set amount of money, on a set day, over a set period of time. In addition to that, investors often will buy more of a stock when it has been unjustly sold off by the market or because they believe in its potential. The online tool for the stock market calculates the average price of shares. Easy to use calculator for averaging the stock and getting more profit from any stock market.

In contrast, B with the same bullish expectation, who did not average up his position, ended with 100 shares. Alternatively, when B exits his position, the net profit is ₹1,14,000. Hence, averaging up can be very profitable when used in a bull market. In this example, dollar-cost averaging paid off by netting a much lower average purchase price than the initial investment. If you just purchased new stocks, it would be useful to calculate the average price by converting their costs, including fees, and using the amount of shares they bought to calculate their market price.

How Does the Stock Average Calculator Work?

It’s up from about 19 times to nearly 25 times, with the sector gaining 17.5% since the start of 2023. Siegel said that Powell’s refusal to reverse course is “overkill,” adding that the central bank “basically beat inflation late last year.” Siegel cited falling prices for commodities, housing and other sectors. Wall Street was coming off a winning week despite volatility related to the Federal Reserve’s latest interest rate hike and the ongoing bank crisis. Despite the recent turmoil, the S&P 500 is on track to finish March flat and the first quarter ending on Friday with an increase of more than 3%. Average daily trading volume to help you identify stocks trading at unusual volumes. As the economy changes over time, so does the composition of the index.

If a stock is moving higher and you believe it may still go higher, you can buy shares at a higher price than your previous price. Unless you’re buying a significant number of shares, it may still be worthwhile to buy the stock. Stock average is calculated by dividing the total cost of the shares by the total number of shares. Averaging into a position can drive to a much different breakeven point from the initial buy.

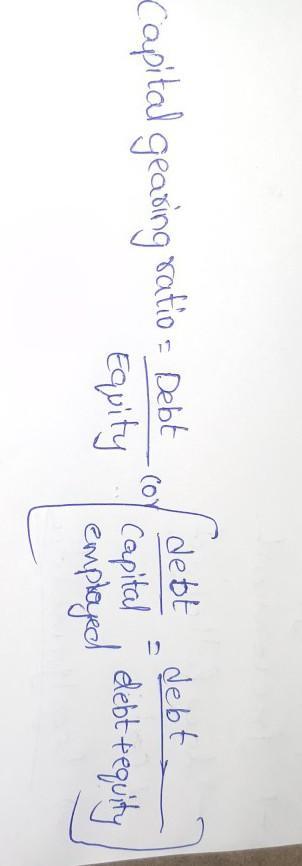

A https://1investing.in/ average is a technical analysis indicator that helps level price action by filtering out the noise from random price fluctuations. Average total cost is calculated by dividing the total cost of production by the total number of units produced. Average price is calculated by taking the sum of the values and dividing it by the number of prices being examined.

Averaging, in the stock market, is a bundle of comprehensive trading strategies that involve the fundamental principle of reducing or increasing your share prices to overcome market volatility. There are multiple kinds of averaging strategies a trader can use in a variety of market settings. For instance, in an emerging bull market, the price of a newly acquired unit acquired decreases due to averaging. The MarketBeat stock average calculator also provides the option for you to enter a stock into the “choose a stock to populate sell price” to put the real-time stock price for that stock into the calculator. Next, enter the number of shares you purchased or wish to purchase.

Global Wealth Strategies & Associates Invests $284000 in Amazon … – MarketBeat

Global Wealth Strategies & Associates Invests $284000 in Amazon ….

Posted: Tue, 28 Mar 2023 09:21:10 GMT [source]

Apart from this, you will also be able to know that after averaging the stock, how many stocks will you have in total and how much amount will be invested in that stock. A composite index is a statistical tool that groups together many different equities or securities. Composite indexes are intended to provide a relative measure of the performance of the market or a specific market sector over time. The index grew to 30 components in 1928 and has changed components a total of 51 times.

Stock Average Calculator

If someone knows what the correct formula is to calculate the average buy price when you buy, sell and rebuy please let me know. With the near-term uncertainties in the economy, analysts don’t see any path to growth in 2023. Paramount posted a sluggish 5% growth in revenue in 2022, with earnings per share cut in half. Only 38% of Wall Street analysts rate the stock a buy, but Berkshire Hathaway is not concerned about temporary obstacles, because it’s normal for the advertising market to experience occasional downturns. You now have your average purchase price for your stock position.

It is critical to understand the average price of your stock position to determine whether it is a profitable investment or not. Is part of the IIFL Group, a leading financial services player and a diversified NBFC. The site provides comprehensive and real time information on Indian corporates, sectors, financial markets and economy. On the site we feature industry and political leaders, entrepreneurs, and trend setters. The research, personal finance and market tutorial sections are widely followed by students, academia, corporates and investors among others. Tax calculators normally use the FIFO method to work out profit or loss for tax purposes.

You will also get first and second buy quantity seperately that helps you to how much quantity you buys till date in that stock. The Dow 30 is a stock index comprised of 30 large, publicly-traded U.S. companies, that acts as an indicator of the market. The median of a set of values is that value where half of the values in the set are lower and half of the values in the set are higher.

Hope now you can easily recall your average concept while calculating the price of the stocks to determine the profitability of a transaction. You can also use the calculator to decide how many shares you have to buy when averaging down or up in a particular stock. Averaging down is a very profitable strategy if the company you’re buying has a history of continued success and has good fundamentals and a strong balance sheet.